Chania Property Market Outlook 2019

Chania Property Market Outlook by ARENCORES. Now in its second edition, it provides an outlook on the Chania property market for 2019.

Emerging Trends in Chania Real Estate® 2019

Chania Real Estate Outlook®, an innovative survey conducted by ARENCORES, is now in its second edition.

This comprehensive report provides an in-depth analysis of the real estate market in Chania for 2019. It is designed to equip property investors and buyers with valuable insights, helping them make informed decisions. The survey covers various aspects of the market, including property values, investment opportunities, and emerging trends.

By leveraging the findings of the Chania Real Estate Outlook®, stakeholders can navigate the dynamic real estate landscape of Chania with confidence and strategic foresight.

Current Trends

Transforming Real Estate: Innovation and Investment in Greece and Beyond

Real estate markets in Greece and abroad are buzzing with innovation and intelligence. A new class of property seekers is revolutionizing the real estate segment by leveraging technology to offer a broader range of services, enhanced flexibility, and increased trust. These “synergistic” operators, while not yet fully tested across economic cycles, are spearheading a new era in real estate investment, due diligence, and property management.

The Hot Tourist & Logistics Sector in Crete

In Crete, the tourist and logistics sector remains exceptionally robust. Foreign investors and investment funds are actively building economically viable real estate assets and services designed for efficient same-day fulfillment and high investment returns. The advent of innovative real estate services, precise property valuations, and access to local real estate data is continually redefining feasibility, reasonableness, and trustworthiness within the market.

Luxury Property Revival in Chania

The Chania real estate market, particularly the luxury property sector, experienced a revival in 2017 and 2018. This segment continues to thrive by offering a combination of diverse choices, magnificent design options, and top-notch leisure services. The demand for luxury properties is driven by both local and international buyers seeking high-quality living spaces and investment opportunities.

Positive Investment Trends in Crete and the Aegean Islands

Investor activity in 2018 exceeded expectations in Crete and the rest of the Aegean islands, with a slight moderation on the mainland. The long-term benefits of investing in real estate remain compelling, including strong income returns, long-term capital safety, and opportunities to add value through investment. The integration of change, intelligence, and innovation further enhances the strategic options available to real estate investors.

Anticipated Capital Deployment in 2019

Following a year of recovery for real estate investment in Chania, investors are poised to deploy more capital in 2019. Survey responses from June 2018 indicated that real estate investors consistently expected their property purchases to exceed those of the previous year. This optimism underscores the confidence in the ongoing growth and potential of the Chania real estate market.

As the market continues to evolve, stakeholders can expect the synergy of technology and real estate to drive unprecedented opportunities and redefine traditional investment paradigms.

Renewed Optimism

Is Optimism Returning to the Greek Real Estate Market?

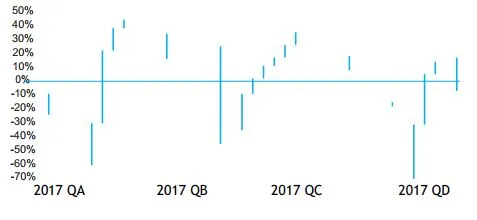

Since 2015, Greece has faced a tumultuous business and political landscape, leading to widespread uncertainty. As a result, optimism among real estate investors has been scarce, as highlighted in the ARENCORES Survey. However, recent data suggests a shift in sentiment.

Rising Optimism Among Real Estate Investors

The latest ARENCORES Survey reveals a growing share of real estate investors who are optimistic about the future financial prospects in Greece. While this optimism has not yet reached positive territory, it has returned to levels not seen since the second quarter of 2008. This resurgence indicates a cautious yet hopeful outlook for the Greek real estate market.

Airbnb's Impact on the Chania Real Estate Market

Airbnb’s Impact on the Chania Real Estate Market

Airbnb is transforming the Chania residential real estate market. The sector is currently thriving, with property values and rates nearing the levels seen before the housing collapse in 2012. Individuals are now purchasing or restoring small apartments and family houses to convert them into short-term rentals, effectively creating lucrative businesses. However, this trend is having a significant impact on local communities, often to the detriment of long-term residents.

Rising Property Values and Short-Term Rental Demand

The demand for short-term rentals, fueled by platforms like Airbnb, has led to a surge in property values. Investors and homeowners alike are capitalizing on the profitability of the short-term rental market, often prioritizing these conversions over traditional long-term rental or ownership models. This shift is making it increasingly difficult for local residents to find affordable housing, as more properties are taken off the market for short-term rental use.