Valuation Market | Transaction / M&A |

|

|

|

|

|

|

| |

| |

|

Crete Real Estate Market and Covid-19: Impacts & Trends.

The Covid-19 pandemic has significantly impacted the Crete real estate market, causing both challenges and shifts in trends.

CRETE’S REAL ESTATE MARKET NOT IMMUNE TO COVID-19 CRISIS.

The recent health crisis delivered a significant shock to the real estate market in Greece, with Crete being particularly affected. The uncertainties and risks associated with the duration and economic impact of the pandemic remain high and challenging to predict.

This report offers a comprehensive examination of the COVID-19 epidemiology’s impact on the real estate market of Crete, drawing insights from various data sources. It delves into several key inquiries, including:

New Coronavirus Restrictions in Crete: Detailing the latest restrictions imposed in Crete to curb the spread of COVID-19 and their implications for the real estate sector.

Current Situation for the Housing Market in Chania: Providing an analysis of the current state of the housing market in Chania, including trends in property sales, rental rates, and inventory levels amid the pandemic.

Future Trends for the Retail Market: Exploring the anticipated trends and shifts in the retail real estate market in Crete post-pandemic, considering factors such as consumer behavior changes and the rise of e-commerce.

Impact on Different Real Estate Sectors: Assessing the sectors of the real estate market most affected by the pandemic, such as hospitality, commercial, and residential properties, and identifying emerging opportunities within these sectors.

Recovery Prospects for Crete’s Real Estate Market: Analyzing the factors influencing the speed and trajectory of the real estate market’s recovery in Crete, including economic conditions, government interventions, and investor sentiment.

By addressing these critical questions, this report aims to provide valuable insights for stakeholders navigating the dynamic landscape of the Crete real estate market amidst the COVID-19 pandemic.

Navigating the Waves.

The public life of Crete was, after governmental orders to slow down the spread of coronavirus and mitigate the severity of the pandemic, as in the whole of Greece, significantly restricted until mid-May. Since the beginning of the pandemic, 352 people have died of COVID-19 throughout Greece till the end of September 23th.

Temporary measures (until 30.09.20)

In the last few days, about 2 to 5 corona-positive cases per day have been registered in Chania and Heraklion, Crete. Most coronavirus cases in Crete came From European travellers.In order to protect public health, the Greek Government for the Prefecture of Chania and Heraklion has temporarily adopted the following measures until 30.09.20:

– Events of any kind are not allowed.

– No gatherings, private or public, of more than nine people are allowed.

– In restaurants, cafes and bars, up to 4 persons per table are allowed (for 1st degree family members up to 6 persons).

– Wearing a protective mask is compulsory both indoors and outdoors. This of course does not apply in the restaurant, when using the pool, when swimming in the sea or outside if a minimum distance of 1.5 – 2.0m can be maintained.

Measures for Chania, Rethymnon and Heraklion, Crete.

The Greek government has had a very cautious and strategic mitigation approach to the coronavirus pandemic from the beginning.

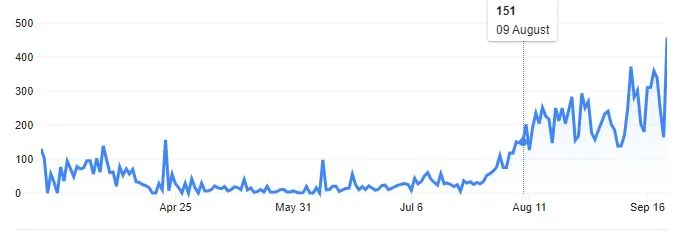

There is evidence of higher infection rates in Heraklion, which is also seeing the sharpest increase in coronavirus infections on the island of Crete. Although new infections on the island of Crete are currently very low (approx. 0 – 4 / day), they are higher than in the previous period (approx. 0 – 1 / day).

The current, temporary measures are intended to prevent a further increase or reduce the number of new infections.

In this context, the above-mentioned temporary restrictions for the region of Chania should also be seen as a cautious preventive measure and not as a reaction to an alleged ‘uncontrolled’ increase of COVID-19 cases.

The economic impact of COVID-19 in Crete

Due to the government restrictions caused by the coronavirus pandemic, Greece as a whole is already facing a profoundly changed economic situation. Company closures and thousands of new unemployed will lead to a recession in 2020. As the pandemic spreads again, conferences and events across agriculture, tourism, technology and sports are being cancelled or postponed.

Travel bans on visitors from high-risk countries, like Italy, the UK, Sweden and Spain and quarantines for international visitors and Greek nationals returning from abroad, have had a huge impact on the tourism industry in Crete.

According to the Greek Reporter, the number of tourist arrivals and revenue from tourism in Greece has taken a dramatic plunge due to the Covid-19 pandemic, with June revenue decreasing by 97.5 percent, as Bank of Greece data shows.

Specifically, there were only 256,000 arrivals in June (a 93.8 percent drop) corresponding to 64 million euros in revenue, a 97.5 drop compared to June 2019. Tourism revenue for the first half of the year was 678 million euros, showing a 87.5 percent decrease compared to the first six months in 2019 when foreign tourism revenue reached 5.41 billion euros.

While the monetary impact on the travel and trade industry is yet to be estimated, it is likely to be in the billions and increasing. Moreover, in a time where new or stricter measures are being taken by the Greek government every day to fight the virus, it is hardly possible to assess the scale of the impact.

But one thing is certain, the effects will also have a short-, mid and long term impact on the Real Estate Market of Crete:

- as the MSCI Greece Index has recorded strong fluctuations with historical lows

and brings uncertainties to real estate investors, - as banks are cutting key interest rates even more sharply and mortgage rates increase,

- as social activities have been shifted because of the pandemic, new criteria have been requested from the potential buyers (space, size, access, fresh-air systems)

- the pandemic has caused a great deal of uncertainty, making macroeconomic forecasting for short-term rental properties (commercial or residential) a challenging task

What does it mean for our clients?

New Trends/ Strategies | Tax / Legal |

|

|

|

|

|

|

|

|

|

|

| Hospitality Market in Crete | Retail Market in Crete | Office / Industrial Market in Crete |

|---|---|---|

| ► The Hospitality market in Crete is so far one of the most affected real estate assets | ► The Retail market in Crete is not facing new lockdowns but its operation is far from normal | ► Office rents in Crete are likely to come under increasing pressure as the new projections show for both the world and the economy of Greece |

| ► Local restrictions and severe economic impacts on accommodation facilities such as hotels, hostels, boutique hotels | ► The anomalies of the everyday tasks and difficulties to operate “business as usual” can put many tenants of commercial premises in financial problems – especially those not situated in popular commercial streets | ► Layoffs and lower demand for office space will impact office lease |

| ► Cafes, restaurants, bars shut at midnight to curb the spread of coronavirus | ► In the case of local restrictions in Crete, retail business owners will be indirectly impacted by the lockdown | ► According to our latest research working from home schemes do not work in Crete |

| ► POX says forecasts of 60-70 percent occupancy levels fell to 15 percent due to the pandemic and are not expected to exceed that figure | ► Many retailers unable to pay their rents are calling for an extension of the mandatory 40.00% reduction in rentals, slated to expire at the end of August, to the end of the year – the question for the new remains | ► Prime office rents expected to fall by at least 15.00 per cent in 2020 |

| Social events are currently prohibited | ► Retail business owners want the government to provide incentives to their landlords to continue keeping rents low voluntarily | ► In the medium term, more and more businesses in Crete (especially in Chania and Heraklion) are likely to be attracted by flexible rental arrangements or short-term leases |

| ► The disruption to overseas travel has resulted in a massive drop to the number of visitors in Crete | ► High-end workspace” may no longer mean “high end” from a luxury perspective but from feeling safe and secure perspective | |

| New Emergency Business plans need to be adapted for the hospitality sector | ||

| Rental agreements in Chania, Heraklion, Rethymnon and Agios Nikolaos are being renegotiated | ||

| ► The majority of new hotel developments and tourism investments in Crete are stopped or postponed |

| Housing Market in Crete (Chania Focus) | Housing Market in Crete (Chania Focus cont.) | Transaction & Investment Market |

|---|---|---|

| ► The COVID-19 pandemic, along with the necessary measures taken, has inevitably taken a heavy toll on the housing market in Chania, Crete | ► The re-shift of Chania City apartments from the short-term option to the long-term one, it will put on rental prices. However, these properties are rented furnished and fully equipped and, in most cases, have been renovated recently, thus this is not expected to lead to significant price adjustments | ► Investors are expected to take a wait-and-see stance in coming quarters, suspending or modifying their plans, anticipating a normalization of the market |

| ► Foreign demand, which had been driving the recovery of the market for the past couple of years, is now non-existent, and major residential property contracts have been frozen, or even cancelled | ► According to Kathimerini, British demand for holiday homes and property in Greece has rocketed by more than 200% – it’s now the hottest search destination in Europe. The interest in luxury properties in Chania may be low in the short and medium term but it remains among 2020’s best real-estate investment in Europe | ► For commercial (tourism infrastructure) real estate investors the pandemic could lead to investment stops or even sales, or require modifications of the investment strategies |

| ► Investors, property sellers and property owners are expected to take a wait-and-see stance in coming quarters, suspending or modifying their plans, anticipating a normalization of the market | ► Chania housing market remains very appealing and attractive enough to European pensioners and non-domestic residents | ► Already signed property investment deals are completed, planned investments are more likely to be suspended |

| ► Some homeowners in Chania are already thinking about rent reductions or shifts from short-term rental platforms to long-term rentals | ► The continued low interest rates ensure a steady demand for home ownership in Chania, Crete | ► Wealthy private investors are likely to reconsider their investment strategies in Crete as the increasing uncertainty is a pervasive and important problem |

| ► Falling rental incomes are putting strains on property owners’ financial position. Longer-term models are now seen as a reliable alternative |